Decentralized finance has made it possible for anyone to interact with financial systems directly, without banks or intermediaries. But as the complexity of DeFi grows, so does the challenge of managing positions, optimizing yields, and controlling risk across multiple protocols. AI can help in overcoming these challenges. These are autonomous programs that don’t just follow preset rules; they learn, predict, and adapt based on real-time market data to execute strategies intelligently on your behalf.

This article explores what DeFi AI agents are, how they operate, and why they are poised to change how individuals and organizations manage assets on-chain.

What Are DeFi AI Agents?

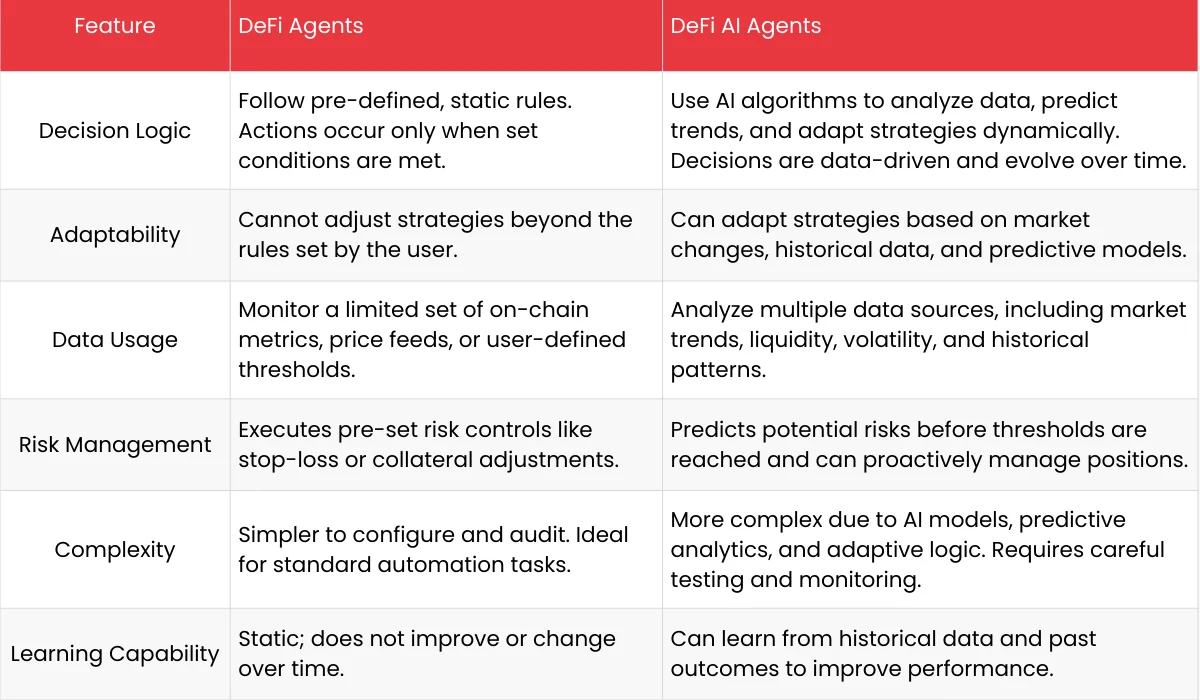

A DeFi AI agent or DeFAI is a software program that automates financial actions on blockchain protocols while using artificial intelligence to guide its decisions. Unlike traditional DeFi agents that follow strict, pre-programmed rules, AI agents analyze multiple signals, detect patterns, and adapt strategies to changing market conditions.

These agents are designed to handle tasks such as rebalancing portfolios, executing trades, optimizing yield, or managing risk, all without requiring constant human supervision. What sets them apart is their ability to learn from past data and adjust actions dynamically, rather than executing static instructions.

In essence, DeFi AI agents combine three elements: autonomy, intelligence, and delegated execution. You remain in control of your assets and define the boundaries of action, but the agent decides how and when to act based on AI-driven insights.

How DeFi AI Agents Are Different From DeFi Agents

Core Components of a DeFi AI Agent

DeFi AI agents are built around several interconnected components:

1. AI Decision Engine

This is the “brain” of the agent. Using machine learning models or predictive algorithms, it evaluates market data, forecasts trends, and determines the best actions to maximize returns or minimize risk. Unlike simple rule-based logic, this engine can adapt to changes in volatility, liquidity, and user-defined objectives.

2. Data Inputs

Agents rely on high-quality, real-time data to make accurate decisions. Price oracles, protocol states, liquidity pools, volatility indices, and historical datasets feed into the AI engine. Accurate and timely data is crucial because the agent’s predictions and decisions depend entirely on the quality of its inputs.

3. Execution Layer

Once a decision is made, the agent interacts with blockchain protocols through smart contracts. It executes trades, adjusts collateral, or reallocates funds, all within the permissions you’ve granted. This layer ensures actions are carried out efficiently, while gas costs and slippage are optimized.

4. User Permissions and Risk Boundaries

AI agents operate with strict rules set by the user. You define what assets the agent can access, maximum transaction sizes, and risk thresholds. Any action outside these boundaries is blocked. This ensures AI intelligence does not compromise control.

5. Monitoring and Feedback Loop

AI agents continuously monitor performance and outcomes. The feedback loop allows them to refine predictions and strategies over time, improving efficiency and adapting to market changes without human intervention.

Also Read: How Machine Learning Helps Banks Detect Fraud Smarter

How DeFi AI Agents Operate in Practice

A DeFi AI agent continuously analyzes the blockchain ecosystem and market signals to make proactive decisions. For example, if a portfolio allocation drifts beyond an optimal range or if a lending position nears liquidation, the agent can react immediately. It can move funds to higher-yield protocols, rebalance positions, or add collateral to prevent liquidation, all automatically.

Unlike human traders or rule-based bots, AI agents for decentralized finance do not require constant supervision. They can predict and respond to events faster than any human could, which is critical in markets that operate 24/7. They also optimize execution, considering factors like gas fees, slippage, and liquidity to maximize efficiency.

1. AI-Driven Portfolio Management

These agents automatically maintain portfolio targets based on risk preferences, predicted returns, and market conditions. For instance, if a particular asset shows increasing volatility, the AI might adjust allocations to reduce exposure while optimizing overall yield.

2. Predictive Trading

AI agents can execute trades based on predicted price movements rather than reacting to static thresholds. By analyzing historical patterns, market trends, and liquidity data, they can anticipate opportunities and act faster than a human trader.

3. Risk Management

AI agents can monitor loan-to-value ratios, liquidation risks, and market volatility. If a position is likely to become under-collateralized, the agent can take preventive action, such as adding collateral or repaying a portion of the debt.

4. Yield Optimization

DeFi AI agents can automatically move funds between lending and staking protocols to maximize returns. They consider expected yield, fees, and risk factors, ensuring capital is always deployed efficiently.

5. DAO Treasury Operations

Decentralized organizations can leverage AI agents to manage treasuries. The agent can predict the best allocation strategies, automate recurring payments, and ensure budgets align with on-chain goals.

What are the Benefits of DeFi Agents

DeFi AI agents introduce several advantages over manual interaction or standard rule-based bots:

- Reduced Manual Effort: Users no longer need to monitor positions constantly or execute repetitive actions.

- Adaptive Execution: Agents can adjust strategies in real-time based on changing market conditions.

- Consistent Rule Enforcement: Unlike human traders, agents do not make emotional decisions and always act according to defined boundaries.

- Faster Risk Response: Agents can respond to emerging risks immediately, reducing potential losses.

- Optimized Capital Use: Funds are reallocated dynamically to maximize yield or minimize exposure.

Scalable Operations: One AI agent can manage multiple protocols and positions simultaneously, which would be impossible manually.

What are the Risks of Using AI in DeFi

While DeFi AI agents offer significant advantages, they also introduce new challenges:

- Data Quality: Predictions are only as good as the data feeding the AI. Inaccurate or delayed data can lead to poor decisions.

- Model Risk: AI models may not perform well in extreme market conditions they haven’t encountered before.

- Complexity: Setting up AI agents requires understanding both DeFi mechanics and AI strategy logic.

- Security: Misconfigured permissions or vulnerabilities in smart contracts can expose funds.

Responsible deployment involves careful configuration, testing on testnets, and monitoring performance continuously.

Conclusion

DeFi AI agents represent a new layer of intelligence in decentralized finance. They combine automation, predictive analytics, and adaptive strategy execution, allowing users to interact with DeFi more efficiently and effectively. By reducing manual effort, improving risk management, and optimizing capital allocation, these agents are reshaping how individuals and organizations approach on-chain financial operations.

If DeFi is the infrastructure, AI agents are the intelligent operators, making the system faster, smarter, and more adaptive to an ever-changing market.

Frequently Asked Questions (FAQ)

Q1. What makes DeFi AI agents different from regular bots?

While traditional bots execute predefined rules, AI agents analyze market data, predict trends, and adapt strategies dynamically. They can respond to conditions before they trigger fixed thresholds, offering smarter, more proactive management.

Q2. Are DeFi AI agents safe?

They can be safe if implemented correctly with proper permissioning and risk limits. The main risks involve inaccurate data, model errors, or security vulnerabilities in the execution layer. Proper configuration and monitoring reduce these risks significantly.

Q3. Do AI agents take custody of my funds?

No, they operate with delegated permissions from your wallet. You retain ownership and can revoke access at any time. The agent only acts within the bounds you define.

Q4. Do they guarantee profits?

No. AI agents automate execution and prediction, but profitability depends on strategy quality and market conditions. They reduce operational risk and human error but cannot remove market risk entirely.