Cloud banking has fundamentally reshaped the financial services industry. By migrating core operations and customer-facing services to cloud environments, banks have been able to scale rapidly, reduce infrastructure costs, and deliver faster, more personalized digital experiences. Today, most banks in major markets such as the United States and India run critical workloads in the cloud, making it a foundational component of modern banking strategy.

However, this transformation has significantly expanded the cybersecurity threat landscape. As financial institutions process vast volumes of sensitive customer data, transaction records, and identity information in cloud environments, they have become prime targets for cybercriminals. Recent research highlights that cloud banking systems face a wide spectrum of threats, including data breaches, insider threats, ransomware, distributed denial-of-service (DDoS) attacks, man-in-the-middle (MitM) attacks, phishing, and API vulnerabilities.

Unlike traditional on-premises systems, cloud banking operates under a shared responsibility model, in which security responsibilities are divided between the cloud service provider and the financial institution. Misconfigurations, weak access controls, unsecured APIs, or inadequate monitoring can expose critical systems to compromise. In such an interconnected digital ecosystem, a single vulnerability can lead to financial losses, regulatory penalties, operational disruption, and long-term reputational damage.

As cloud infrastructure becomes central to global financial operations, securing it is no longer optional; it is a strategic imperative. In this guide, we will explore cloud security best practices for financial services and how banks can achieve enterprise cloud security.

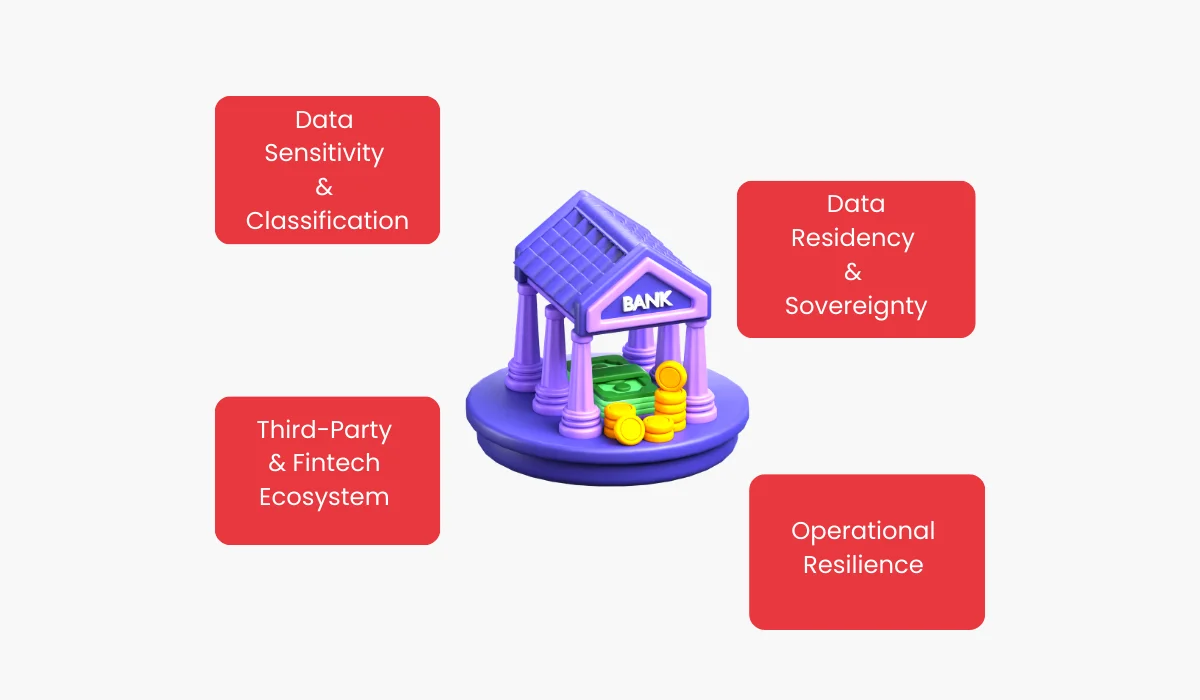

Top Security Areas Where Banks and Financial Services Should Focus

Given the rising frequency of cloud-related attacks on banks, from unsecured cloud storage in India exposing hundreds of thousands of records, to ransomware targeting U.S. fintech vendors, it’s clear that financial institutions must thoroughly understand the key areas to ensure secure cloud implementation.

1. Data Sensitivity & Classification

Why it matters: Not all data is equally valuable or sensitive. Customer PII, payment credentials, and financial records are prime targets for cybercriminals. Treating all data the same can lead to either overprotecting trivial data or underprotecting critical assets, increasing the likelihood of breaches and regulatory penalties.

Example: The 2025 AWS misconfigured storage bucket in India exposed thousands of customer transactions because sensitive data was not properly isolated, a costly lesson in the importance of classification.

Impact: Mishandling Tier 1 data can lead to regulatory fines, reputational damage, and loss of customer trust, while poorly protected Tier 2 data can disrupt operations or give competitors an advantage.

2. Data Residency & Sovereignty

Why it matters: Regulators in India and the U.S. require certain financial data to remain within national borders. Violating these rules can result in hefty fines and legal complications. Moreover, cross-border data storage without proper safeguards can increase exposure to international cyber threats.

Example: Indian banks using cloud services must ensure UPI transaction data is stored locally. Similarly, U.S. banks often keep state-level PII segregated to comply with privacy laws.

Impact: Ignoring residency requirements can jeopardize compliance, trigger audits, and harm public trust, even if no breach occurs.

3. Operational Resilience

Why it matters: Cloud providers manage hardware, but banks remain responsible for application uptime. Downtime or data loss during a cyberattack can disrupt payments, mobile banking, and ATMs, causing financial losses and customer dissatisfaction.

Example: Past cloud outages have temporarily blocked customer transactions and payment processing, demonstrating that even well-secured data is useless if services aren’t resilient.

Impact: Without robust multi-region failover and high-availability architecture, banks risk service disruptions, regulatory scrutiny, and long-term reputational damage.

4. Third-Party & Fintech Ecosystem Risk

Why it matters: Banks increasingly rely on third-party fintechs and APIs for services like Open Banking. Every partner adds potential vulnerabilities. A breach in a vendor’s cloud environment can indirectly compromise bank systems.

Example: The 2026 U.S. fintech ransomware incident affected multiple banks indirectly through a cloud vendor, highlighting the risk of third-party dependencies.

Impact: Weak security among partners can lead to data breaches, operational downtime, and cascading financial losses, even if the bank’s own cloud systems are secure.

Also Read: 10 Best Cloud Migration Strategies for Enterprises 2026

5 Advanced Cloud Security Practices for Banks and Financial Institutions

Implementing cloud securely in banks and financial institutions requires a comprehensive strategy that goes beyond basic measures. Start with these best practices.

1. Confidential Computing and Enclave-Based Workloads

Process sensitive data in secure enclaves or confidential computing nodes to keep it encrypted even while in use. Isolate critical workloads, such as payment processing or risk analytics, from general-purpose cloud resources.

Why it matters: Even if a cloud host is compromised, data in enclaves remains protected. This is essential for protecting high-value financial data against insider threats or sophisticated external attacks.

2. Immutable Infrastructure and Infrastructure-as-Code Security

Use infrastructure-as-code (IaC) to deploy cloud resources with security checks built in, and enforce immutable server or container images to prevent unauthorized changes. Automatically scan IaC templates for misconfigurations before deployment.

Why it matters: Misconfigured cloud resources are a common attack vector. Immutable, IaC-driven deployments reduce human error, ensure predictable security, and protect sensitive financial workloads from accidental exposure.

3. Zero Trust Architecture

Implement zero trust principles: verify every user, device, and API request regardless of network location. Segment workloads, enforce micro-segmentation for sensitive data, and continuously monitor user behavior for anomalies.

Why it matters: Zero trust minimizes lateral movement in the cloud, strengthening enterprise cloud security and protecting critical data and applications. If one account or service is compromised, attackers cannot easily access other systems, protecting critical data and applications.

4. Continuous Threat Intelligence and Cloud Honeypots

Deploy cloud honeypots and deception technologies to detect attackers early. Integrate real-time threat intelligence to block emerging malware, ransomware, or API attacks, and continuously update web application firewalls and intrusion detection systems.

Why it matters: Early detection of sophisticated attacks prevents breaches before they impact operations. This proactive approach is crucial for cloud-hosted banking systems that are frequent targets of advanced cybercriminals.

5. Automated Compliance and Security Posture Management

Continuously monitor cloud environments against regulatory and industry standards (RBI, FFIEC, PCI DSS, GDPR). Automate compliance audits, policy enforcement, and incident alerts, and integrate findings with SIEM and SOAR platforms.

Why it matters: Financial institutions face strict regulatory scrutiny. Automated posture management ensures ongoing compliance, reduces human error, and strengthens financial institution cybersecurity.

6. Advanced Data Protection in Cloud: Tokenization and Data Masking

Apply tokenization or format-preserving encryption for sensitive data fields. Mask production data in non-production environments or when sharing with third-party services.

Why it matters: Even if data is accessed by unauthorized parties, tokenization and masking limit exposure. This is especially important in multi-tenant cloud environments and third-party integrations.

Conclusion

Cloud adoption gives banks the speed and flexibility to innovate, but it also exposes them to sophisticated cyber threats. Implementing cloud security best practices, from zero trust and advanced encryption to continuous monitoring and secure third-party integration, is essential to protect sensitive data and maintain regulatory compliance.

Softude leverages years of hands-on experience in cloud platforms and cybersecurity to build truly secure, resilient cloud environments. Drawing on our deep expertise in enterprise cloud security, we safeguard sensitive data, ensure regulatory compliance, and deploy cloud solutions for our clients, enabling them to innovate boldly while minimizing risk and protecting customer trust.

Contact us for secure cloud implementation in your bank and financial institution.